You are too broke to own a home in America!

May 29, 2014 in News by RBN Staff

Source: My Budget 360

People continue to scratch their heads as to why regular home buyers in America are unable to enter the housing market. Prices are up but this is mostly because of investor money that is obsessed with chasing yield in a low yield environment orchestrated by the Federal Reserve. The reason home sales figures continue to be weak sans investors is that U.S. households are too broke! We now hear people moaning and complaining that lending standards are too tough because they actually have to document their income and put some skin in the game. Unfortunately, most Americans are living paycheck to paycheck and are using access to debt to live in denial that their standard of living is truly declining. The latest sales figures show that the median priced home in the U.S. is selling for $201,000. This is too high for a household making $50,000 a year (the typical American family). Since the recent increase in prices was largely driven by a voracious demand from investors, regular home buyers are wondering why they are unable to partake in the American Dream of owning a home. First of all, the big American Dream was having a strong and healthy middle class which is quickly shrinking. The reason homeownership is falling in America is that current home values put real estate out of reach for most Americans unless they go into massive levels of debt. Many are too broke to own a home!

Housing values far outpacing overall inflation and income gains

The housing market is quickly outpacing any sort of normal inflationary gains. The BLS CPI measure of course is missing the entire jump from last year because it is focused only on what a home would yield in rent. This is a poor measure but then again, this missed the previous housing bust.

Housing will consume the biggest portion of your income regardless of you being a renter or an actual home owner. Owning a primary residence is not an investment! An investment usually kicks money back your way instead of draining it out of your wallet. Of course there is so much propaganda on owning that people continue to buy even if prices are far beyond their reach.

First, it might be useful to take a look at true housing values via the Case Shiller Index and how they have performed since 2000:

The Case Shiller 10 City index has prices up 86 percent from 2000 and 71 percent if we look at the newer 20 City Index:

It would then be useful to see how this compares to the overall inflation rate since 2000:

Source: BLS

That is interesting. According to the CPI we are up 38 percent since 2000. So why are housing prices going up nearly twice the rate of the CPI? Thanks to our current financial system debt is the currency of choice from banks and the system is flooded with easy money. The only problem of course is that banks and investors are crowding out regular buyers in this new market because U.S. households have seen no inflation adjusted wage growth for nearly a generation:

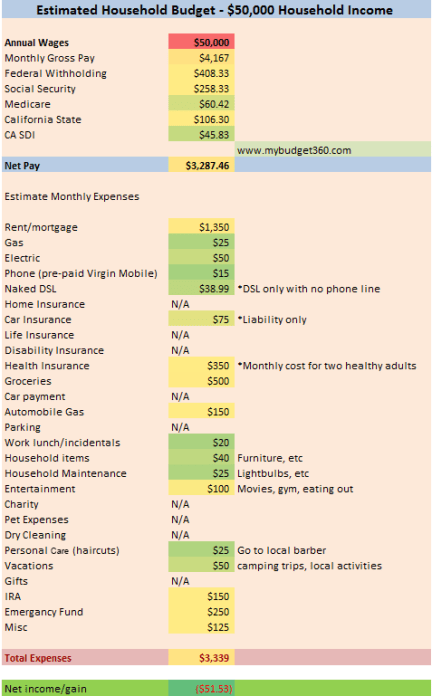

In other words, households are too broke to purchase in today’s market! Even with low interest rates a regular U.S. household cannot buy the median priced home of $201,000 with the median household income of $50,000 without stretching their budget and foregoing retirement planning. It might help to look at a budget for this household:

The below budget is examining a household in California. First, good luck finding an affordable house in the state (keep in mind the median income in the state is roughly $60,000 so don’t think it is far off from the above budget). But assume this hypothetical family found a home in a lower priced city of California for $250,000. Can they afford it? No! But of course, we have FHA backed loans that allow people to buy with only 3.5 percent down:

This household will be dishing out $1,770 a month, or more than 53 percent of their net take home pay on their housing payment. Most buyers are going in with very little down outside of the big investors. The regular household would be hard pressed for a 10 percent down payment ($20,000) let alone a 20 percent down payment ($40,000). You already see in the budget that this will severely cut into their retirement planning. Most Americans are winging it when it comes to retirement. For those that own, their retirement plan is their home but a home does not throw off income!

I think it is critical to understand what is going on here and that is housing is becoming unaffordable to many throughout the country. Many will take on debt and put every extra penny into their property. They forget to plan for retirement or to save for things outside of housing. This is why we now have an impending retirement crisis on hand. Say you now pay off your home. Great. You still have insurance, taxes, and maintenance forever! Where is your income going to come from in retirement? Certainly not your home unless you sell but then you still need shelter. Most people don’t think this far out and are betting that Social Security will be there for 10, 20, or 30 years of their retirement and will provide them with enough to comfortably get by. That is not going to be the case. The fact that housing values jumped in 2013 because of investor money and regular buyers are out of the market should tell you something else. Most Americans are too broke to buy. Of course many will go into massive debt trying to cling on to the fading ideals of the American Dream. You need to run the numbers carefully and realize that owning a home is not a clear cut decision.