Central Banks Continue “Remarkable” Gold-Buying Spree

January 9, 2020 in News by RBN Staff

Source: Zero Hedge

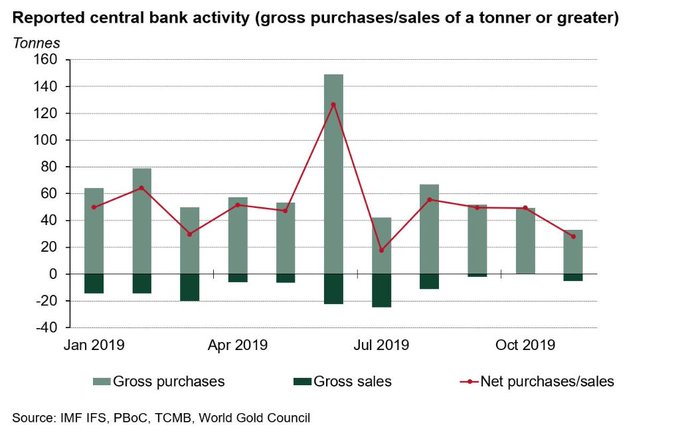

Central banks continued their remarkable gold-buying spree in November and remain on pace to eclipse 2018’s near-record purchases.

According to the latest numbers from the World Gold Council, central banks added 27.9 tons on a net-basis to official gold reserves in November. That brings the yearly total for 2018 with one month left to calculate to 570.2 tons, 11% higher than the same period in the previous year.

“The scale of purchases year-to-date remains remarkable.” In his latest Goldhub blog post, Krishan Gopaul, of our research team, discusses our recently released central bank gold reserves statistics, covering November 2019: http://spr.ly/60151b8QW

In 2018, central banks purchased just over 650 tons. According to the WGC, that was the highest level of annual net central bank gold purchases since the suspension of dollar convertibility into gold in 1971, and the second-highest annual total on record

The World Gold Council bases its data on information submitted to the International Monetary Fund.

Turkey led the pack for the third straight month, adding another 17 tons of gold to its reserves in November. The Turks have leapfrogged the Russians as the number-one gold-buyer in 2019 with over 181 tons added to their hoard. Turkish consumers are also flocking to the yellow metal. According to Bloomberg, gold demand was up 3.7% in the first nine months of 2019. The country’s government has loosened rules governing gold imports to meet the growing demand.

Russia added another 9.7 tons of gold to its reserves in November. That brings its total gold purchases to nearly 149 tons so far in 2019. Russia’s quest for gold has paid off in a big way. The Russian Central Bank’s gold reserves topped $100 billion in September thanks to continued buying and surging prices.

The Russians have been buying gold for the last several years in an effort to diversify away from the US dollar. Russian gold reserves increased 274.3 tons in 2018, marking the fourth consecutive year of plus-200 ton growth. Meanwhile, the Russians sold off nearly all of its US Treasury holdings. According to Bank of America analysts, the amount of US dollars in Russian reserves fell from 46% to 22% in 2018.

After pausing for a couple of months, Kazakhstan got back into the gold-buying business in November, adding 4.6 tons of gold to its stash.

Other gold-buying central banks in November were Mongolia (2 tons) and Thailand (0.1 ton.)

Columbia was the only big seller, divesting itself of just over 5 tons of gold in November.

For the second month in a row, the People’s Bank of China did not report any gold purchases. It’s not uncommon for China to go silent and then suddenly announce a large increase in reserves.

The World Gold Council called the scale of central bank gold purchases in 2019 “remarkable.”

Following the 50-year high in 2018, few (including us) expected the buying strength we have seen.”

The central bank gold-buying spree is expected to continue into 2020 as countries continue to create a hedge against geopolitical risk and diversify their reserves away from the US dollar.

World Gold Council director of market intelligence Alistair Hewitt said there are two major factors driving central banks to buy gold – geopolitical instability and extraordinarily loose monetary policy.

Central banks are looking toward gold to balance some of that risk. We’ve also got negative rates and yields for a large number of sovereign bonds.”

The extraordinarily loose monetary policy shows no sign of reversing. The Federal Reserve appears to have paused rate cuts, but Chairman Jerome Powell has made it clear that the central bank does not plan on raising rates, even if inflation begins to heat up.

Peter Schiff has talked about central bank gold-buying. He has noted that the US went off the gold standard in 1971, but he thinks the world is going to go back on it.

The days where the dollar is the reserve currency are numbered and we’re going back to basics. You know, everything old is new again. Gold was money in the past and it will be money again in the future, and central banks that are smart enough to read that writing on the wall are increasing their gold reserves now.”

Ron Paul made a similar point in an episode of the Liberty report. He said foreign central banks are increasingly gravitating to sound money like gold and ripping themselves away from the Fed’s dollar.

The central banks of the world are looking at gold again.”